| By Order of the Board of Directors |

|

| Roger L. Dick |

| President and Chief Executive Officer |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

UWHARRIE CAPITAL CORPUwharrie Capital Corp

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Uwharrie Capital Corp

132 North First Street

Albemarle, North Carolina 28001

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

and

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

NOTICE is hereby given that the Annual Meeting of Shareholders of Uwharrie Capital Corp (the “Company”) will be held as follows:

| Place: | Stanly County Agri-Civic Center | |||

| 26032 Newt Road | ||||

| Albemarle, North Carolina | ||||

| Date: | Tuesday, May | |||

| Time: | 4: | |||

| Buffet Dinner & Fellowship | ||||

| 6: | Recognitions | |||

| 6:30 p.m. | Business Meeting | |||

The purposes of the meeting are:

| 1. | To elect six (6) directors to three (3) year terms and one (1) director to a two (2) year term; |

| 2. | To |

| 3. |

| To ratify the appointment of Dixon Hughes PLLC as the Company’s independent registered public |

| To transact such other business as may properly be presented for action at the meeting. |

YOU ARE INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. HOWEVER, EVEN IF YOU PLAN TO ATTEND, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED APPOINTMENT OF PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED FOR THAT PURPOSE TO ENSURE THAT A QUORUM IS PRESENT AT THE MEETING. THE GIVING OF AN APPOINTMENT OF PROXY WILL NOT AFFECT YOUR RIGHT TO REVOKE IT OR TO ATTEND THE MEETING AND VOTE IN PERSON.You are invited to attend the annual meeting in person. However, even if you plan to attend, you are requested to complete, sign and date the enclosed appointment of proxy and return it promptly in the envelope provided for that purpose or to vote via the internet in order to ensure that a quorum is present at the meeting. The giving of an appointment of proxy will not affect your right to revoke it or to attend the meeting and vote in person.

We have elected to furnish our proxy solicitation materials via U.S. mail and also to notify you of the availability of our proxy materials on the internet. The notice of annual meeting, proxy statement, proxy card and annual report are available at www.uwharrie.com/vote.

| By Order of the Board of Directors |

|

| Roger L. Dick |

| President and Chief Executive Officer |

March 22, 200631, 2009

Uwharrie Capital Corp

132 North First Street

Albemarle, North Carolina 28001

704-982-4415

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation by the Board of Directors of Uwharrie Capital Corp (the “Company”) of appointments of proxy for use at the annual meeting of the Company’s shareholders (the “Annual Meeting”) to be held on May 2, 2006,12, 2009, at 4:006:30 p.m., in the Stanly County Agri-Civic Center, 26032 Newt Road, Albemarle, North Carolina, and at any adjournments thereof. The Company’s proxy solicitation materials are being mailed to shareholders on or about March 22, 2006.31, 2009 to shareholders of record as of March 6, 2009.

Voting of Proxies

Persons named in the enclosed appointment of proxy as proxies (the “Proxies”) to represent shareholders at the Annual Meeting are Roger L. Dick, Brendan P. Duffey and Christy D. Stoner. Shares represented by each appointment of proxy which is properly executed, returnedsubmitted by mail or the internet and not revoked, will be voted in accordance with the directions contained therein. If no directions are given, such shares will be voted “FOR” the election of each of the seven (7) nominees for director named in Proposal 1 and “FOR” Proposals 2 3 and 4.3. If, at or before the time of the Annual Meeting, any nominee named in Proposal 1 has become unavailable for any reason, the Proxies will be authorized to vote for a substitute nominee. On such other matters as may come before the meeting, the Proxies will be authorized to vote in accordance with their best judgment.

Record Date

The close of business on March 1, 20066, 2009 has been fixed as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record on that date will be eligible to vote on the proposals described herein.

Voting Securities

The Company’s voting securities are the shares of its common stock, par value $1.25 per share, of which 7,138,6867,593,929 shares were outstanding on March 1, 2006.6, 2009. There were approximately 3,525 holders of record3,499 shareholders of the Company’s common stock on that date.December 31, 2008.

Voting Procedures; Quorum; Votes Required for Approval

At the Annual Meeting, each shareholder will be entitled to one vote for each share held of record on the Record Date on each matter submitted for voting and, in the election of directors, for each director to be elected. In accordance with North Carolina law, shareholders will not be entitled to vote cumulatively in the election of directors.

A majority of the shares of the Company’s common stock issued and outstanding on the Record Date must be present in person or by proxy to constitute a quorum for the conduct of business at the Annual Meeting.

Assuming a quorum is present, in the case of Proposal 1 below, the seven (7) directorsnominees receiving the greatest number of votes shall be elected.

In the case of Proposals 2 3 and 4 below,3, for each such proposal to be approved, the number of votes cast for approval must exceed the number of votes cast against the proposal. Abstentions and broker non-votes will have no effect.

Revocation of Appointment of Proxy

Any shareholder who executes an appointment of proxy has the right to revoke it at any time before it is exercised by filing with the Secretary of the Company either an instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Expenses of Solicitation

The Company will pay the cost of preparing, assembling and mailing this Proxy Statement. Appointments of proxy also may be solicited personally or by telephone by the directors, officers and employees of the Company and its subsidiaries without additional compensation. The Company will reimburse banks, brokers and other custodians, nominees and fiduciaries for their costs in sending the proxy materials to beneficial owners.

Authorization to Vote on Adjournment and Other Matters

Unless the Secretary of the Company is instructed otherwise, by signing an appointment of proxy, shareholders will be authorizing the Proxies to vote in their discretion regarding any procedural motions that may come before the Annual Meeting. For example, this authority could be used to adjourn the Annual Meeting if the Company believes it is desirable to do so. Adjournment or other procedural matters could be used to obtain more time before a vote is taken in order to solicit additional appointments of proxy to establish a quorum or to provide additional information to shareholders. However, appointments of proxy voted against any one of the Proposals will not be used to adjourn the Annual Meeting. The Company does not have any plans to adjourn the meeting at this time, but intends to do so, if needed, to promote shareholder interests.

Beneficial Ownership of Securities by Directors, Nominees and Executive Officers

As of March 1, 2006, there were6, 2009, no persons who wereshareholder known to management of the Company to beneficially ownowned more than 5% of the Company’s common stock. stock, except as disclosed in the following table.

2

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||

Uwharrie Capital Corp Employee Stock Ownership Plan and Trust Albemarle, NC | 390,077 | (1) | 5.14 |

| (1) | Robert O. Bratton, Roger L. Dick, Brendan P. Duffey, David C. Gaskin, Susan B. Gibson, J. Michael Massey, Christy D. Stoner, and Barbara S. Williams serve as trustees for the Uwharrie Capital Corp Stock Ownership Plan and Trust (the “ESOP”). |

The following table lists the individual beneficial ownership of the Company’s common stock as of March 1, 2006,

2

6, 2009, by the Company’s current directors, nominees for director and executive officers, and by all current directors, nominees and executive officers of the Company as a group. Current directors and executive officers as a group beneficially owned 7.81%14.30% of the shares outstanding or options exercisable by members of the groupCompany’s common stock on such date.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | ||

Robert P. Barbee Charlotte, NC | 1,190 | 0.02 | ||

Robert B. Brannan, III Concord, NC | 1,500 | 0.02 | ||

Joe S. Brooks Albemarle, NC | 21,307(3) | 0.30 | ||

Roger L. Dick Albemarle, NC | 91,788(4) | 1.27 | ||

Brendan P. Duffey Cary, NC | 14,717 | 0.21 | ||

Virginia R. Dunn(5) Charlotte, NC | 0 | 0.00 | ||

Charles F. Geschickter, III Stanfield, NC | 839 | 0.01 | ||

Thomas M. Hearne, Jr. Albemarle, NC | 9,146 | 0.13 | ||

Patricia K. Horton Concord, NC | 2,790(6) | 0.04 | ||

Joseph R. Kluttz, Jr. Albemarle, NC | 6,766 | 0.09 | ||

W.D. “Bill” Lawhon, Jr. Albemarle, NC | 17,713(7) | 0.25 | ||

B. Franklin Lee Norwood, NC | 6,268 | 0.09 | ||

W. Chester Lowder Norwood, NC | 3,245(8) | 0.05 | ||

John P. Murray, M.D. Albemarle, NC | 18,842 | 0.26 | ||

James E. Nance Albemarle, NC | 35,705(9) | 0.50 | ||

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | |||

W. Stephen Aldridge, III Albemarle, NC | 2,400 | (3) | 0.03 | ||

Robert O. Bratton Concord, NC | 257 | 0.00 | |||

Joe S. Brooks Albemarle, NC | 23,066 | (4) | 0.30 | ||

Ronald T. Burleson Richfield, NC | 18,864 | (5) | 0.25 | ||

Bill C. Burnside Albemarle, NC | 12,875 | (6) | 0.17 | ||

Roger L. Dick Albemarle, NC | 109,066 | 1.42 | |||

Brendan P. Duffey Cary, NC | 68,295 | 0.89 | |||

Henry E. Farmer, Sr. Albemarle, NC | 5,806 | 0.08 | |||

Charles F. Geschickter, III Stanfield, NC | 915 | 0.01 | |||

Thomas M. Hearne, Jr. Albemarle, NC | 12,195 | 0.16 | |||

3

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | |||||

Charles D. Horne Wadesboro, NC | 913 | 0.01 | |||||||

Patricia K. Horton Concord, NC | 5,680 | (7) | 0.07 | ||||||

W. Kenneth Huntley Wadesboro, NC | 3,835 | 0.05 | |||||||

Joseph R. Kluttz, Jr. Albemarle, NC | 7,390 | 0.10 | |||||||

W.D. “Bill” Lawhon, Jr. Albemarle, NC | 33,444 | (8) | 0.44 | ||||||

Lee Roy Lookabill, Jr. Wadesboro, NC | 7,348 | (9) | 0.10 | ||||||

W. Chester Lowder Norwood, NC | 3,541 | (10) | 0.05 | ||||||

Barry S. Moose Mt. Pleasant, NC | 3,314 | (11) | 0.04 | ||||||

James E. Nance Albemarle, NC | 38,796 | (12) | 0.51 | ||||||

Emmett S. Patterson Wadesboro, NC | 1,190 | 0.02 | 1,298 | 0.02 | |||||

Timothy J. Propst Concord, NC | 10,657(10) | 0.15 | 11,639 | (13) | 0.15 | ||||

Susan J. Rourke Harrisburg, NC | 2,833 | 0.04 | 3,092 | 0.04 | |||||

Donald P. Scarborough Polkton, NC | 2,169 | 0.03 | 9,262 | (14) | 0.12 | ||||

John W. Shealy, Jr. Concord, NC | 3,938 | 0.06 | 4,302 | 0.06 | |||||

Michael E. Snyder, Sr. Albemarle, NC | 69,498 | 0.97 | 84,401 | 1.11 | |||||

Douglas L. Stafford Albemarle, NC | 14,012 | 0.20 | 15,309 | 0.20 | |||||

Christy D. Stoner Albemarle, NC | 118,741(11) | 1.64 | 134,828 | (15) | 1.75 | ||||

Jimmy L. Strayhorn Wadesboro, NC | 37,976 | 0.53 | |||||||

Emily M. Thomas Wadesboro, NC | 2,316 | 0.03 | |||||||

Hugh E. Wallace Wadesboro, NC | 81,069 | 1.14 | |||||||

All current directors and executive officers as a group (26 persons) | 576,215(12) | 7.81 | |||||||

4

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | |||

Jimmy L. Strayhorn Wadesboro, NC | 70,483 | 0.92 | |||

Jeffrey M. Talley Stanfield, NC | 5,001 | (16) | 0.07 | ||

Emily M. Thomas Wadesboro, NC | 2,529 | 0.03 | |||

Edward B. Tyson Kannapolis, NC | 6,869 | (17) | 0.09 | ||

Barbara S. Williams Albemarle, NC | 37,494 | (18) | 0.49 | ||

All current directors, nominees and executive officers as a group (32 persons) | 1,134,584 | (19) | 14.30 | ||

| (1) | Except as otherwise noted, to the best knowledge of management of the Company, the individuals named or included in the group above exercise sole voting and investment power with respect to all shares shown as beneficially owned. The calculations of the percentage of class beneficially owned by each individual are based on a total of |

| (2) | Includes shares over which the named individual shares voting and investment power as follows: Mr. Brooks – |

| (3) | Includes |

| (4) | Includes 327 shares held by Mr. Brooks’ |

4

| (5) |

| (6) | Includes |

| (7) | Includes 1,994 shares held by Ms. Horton’s spouse and |

| Includes |

| Includes |

| (10) | Includes 666 shares held by Mr. Lowder’s adult child. |

| Includes |

5

| (12) | Includes 6,500 shares held by Mr. Nance’s spouse and |

| Includes |

| Includes |

| (15) | Includes 4,019 shares held by Ms. Stoner as custodian for a minor child. |

| Includes 887 shares held by Mr. Talley’s spouse. |

| (17) | Includes 5,293 shares held by Mr. Tyson’s spouse. |

| (18) | Includes 646 shares held by Ms. Williams’ spouse. |

| (19) | Includes an aggregate of |

Section 16(a) Beneficial Ownership Reporting Compliance

Directors and executive officers of the Company are required by federal law to file reports with the Securities and Exchange Commission (“SEC”) regarding the amount of and changes in their beneficial ownership of the Company’s common stock. To the knowledge of the management of the Company based upon information supplied to the Company by the directors and executive officers, all required reports of directors and executive officers of the Company have been timely filed.filed with the exception of an initial report of beneficial ownership (Form 3) for director Barry S. Moose who was appointed by the Board of Directors in December to fill an unexpired term.

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees

The Company’s Bylaws provide for a Board of Directors composed of eighteen (18) members divided into three classes, each consisting of six (6) directors who are elected to terms of three (3) years. Each year the terms of six (6) directors expire and six (6) persons are elected as directors for new three (3) year terms. The Board of Directors has nominated the six (6) persons named belowin the following table for election by shareholders at the Annual Meeting as directors of the Company for three (3) year terms and one (1) person for a two (2) year term or, in each case, until their respective successors are duly elected and qualified. The Board has also nominated one (1) additional nominee, who was originally appointed to fill a vacancy, for re-election to the Board of Directors for a term of two (2) years.

56

Name and Age | Position

| Year

| Principal Occupation and Business Experience for the Past Five Years | |||

| ||||||

| President, | |||||

| ||||||

| ||||||

| ||||||

| ||||||

| 2000/ | |||||

Joseph R. Kluttz, Jr. (70) | Director | 2005/2012 | President, Albemarle Insurance Agency, Inc., Albemarle, NC | |||

Lee Roy Lookabill, Jr. (60) | Nominee | 2003/2012 | President, Anson Real Estate and Insurance Company, Inc. Wadesboro, NC | |||

Edward B. Tyson (68) | Nominee | 2003/2012 | Retired; previously, Kannapolis City Schools Superintendent, Kannapolis, NC | |||

| ||||||

| Director(2) |

| ||||

| (1) | The year first elected indicates the year in which each individual was first elected a director of the Bank of Stanly, Anson Bank & Trust Co., Cabarrus Bank & Trust Company or the Company, as applicable and does not reflect any break(s) in the named individuals’ tenures as directors of the Bank of Stanly, Anson Bank & Trust Co., Cabarrus Bank & Trust Company or the Company, as applicable. |

| (2) | Mr. Moose was appointed to the Board of Directors on December 16, 2008 to fill a vacancy resulting from the death of Dr. John P. Murray in July, 2008. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE NOMINEES NAMED IN PROPOSAL 1 ABOVE.

Incumbent Directors

The Company’s current Board of Directors includes eleven (11) directors whose terms will continue after the Annual Meeting. The following table contains information about those eleven (11) incumbent directors.

67

Name and Age | Position

| Year

| Principal Occupation and Business Experience

| |||

| ||||||

Joe S. Brooks

| Director | 1997/ | Owner and Manager, Brothers Precision Tool Company, Albemarle, NC (tool and dye machine shop) | |||

Ronald T. Burleson (59) | Director | 1997/2011 | Partner, Thurman Burleson & Sons Farm, Richfield, NC (cotton and grain farming operation and partner in cotton gin) | |||

Henry E. Farmer, Sr. (75) | Director | 2006/2010 | Retired; previously, President and Owner, Henry E. Farmer, Inc., Albemarle, NC (chemical specialty business) | |||

Charles F. (“Tad”) Geschickter, III (46) | Director | 2005/2011 | President and Chief Executive Officer, ST Motorsports, Inc; JTG Racing, Inc., Harrisburg, NC | |||

Thomas M. Hearne, Jr.

| Director | 2004/ | Geopavement Engineer, North Carolina Department of Transportation, Harrisburg, NC | |||

| Director | |||||

W. Chester Lowder

| Director | 1995/ | Director of Livestock Program, Public Policy Division, North Carolina Farm Bureau Federation, Incorporated, | |||

| ||||||

Timothy J. Propst

| Director | 2003/ | Executive Vice President, Propst Construction Co., Inc., Concord, NC (utilities and soil stabilization construction) | |||

Susan J. Rourke

| Director | 2003/ | President, | |||

Donald P. Scarborough

| Director | 2004/ | President | |||

John W. Shealy, Jr.

| Director | 2003/ | President, | |||

| ||||||

| (1) | The year first elected indicates the year in which each individual was first elected a director of the Bank of Stanly, Anson Bank & Trust Co., Cabarrus Bank & Trust Company or the Company, as applicable, and does not reflect any break(s) in certain of the named individuals’ tenures as directors of the Bank of Stanly, Anson Bank & Trust Co., Cabarrus Bank & Trust Company or the Company, as applicable. |

78

Director Independence

Each member of the Company’s Board of Directors and each nominee for election to the Board is “independent” as defined by NASDAQ listing standards and by the rules and regulations promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”). In making this determination the Board considered any material insider transactions between directors or nominees for director and the Company or its subsidiaries. All such transactions were conducted at arm’s length upon terms no less favorable than those that would be available from an independent third party.

Director Relationships

No director is a director of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”) or subject to the requirements of Section 15(d) of the Exchange Act, or any company registered as an investment company under the Investment Company Act of 1940.

Director Compensation

During 2005, each director received a fee of $200 for each Board of Directors meeting attended and $100 for attendance at each meeting of a committee.

On March 1, 1994, the Company established a Directors’ Deferred Compensation Plan in accordance with the laws of the State of North Carolina under which each director could elect to defer receipt for services rendered to the Company as a director during the term of his or her service by entering into a written deferred compensation election. This plan was closed to new participants in 2001; subsequently, only two directors continue to defer receipt of fees under the plan.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company held nine (9)eight (8) regular meetings during 2005.2008. Each current director attended 75% or more of the aggregate number of meetings of the Board of Directors and of any committees on which he or she served, except Joe S. Brooks, B. Franklin LeeMessrs. Farmer and Susan J. Rourke, who eachLowder of whom attended fewer than 75% due to prior business commitments.

It is the policy of the Company that directors attend each annual meeting and any special meetings of the Company’s shareholders. Sixteen (16)Fourteen (14) of the Company’s eighteen (18) directors attended the 20052008 annual meeting of shareholders.

The Company’s Board of Directors has several standing committees, including a Human Resources (Compensation) Committee, a Nominating Committee and an Examining (Audit) Committee.

Human Resources Committee. The current members of the Human Resources Committee, which performs the functions of a compensation committee, are Joe S. Brooks - Chair, Charles F. Geschickter, III, W. Chester Lowder, Timothy J. Propst, - Chair, Robert P. Barbee, B. Franklin Lee, W. Chester Lowder, Susan J. Rourke, Donald P. Scarborough and Emily M. Thomas. All members of the Human Resources Committee are independent directors. The Human Resources Committee reviews the compensation process for the Company and its subsidiaries to ensure it is consistent with corporate and board policy. The Human Resources Committee serves as the catalyst for the development of compensation related recommendations for all officers of the Company and its subsidiaries and meets with representatives of the Company and each subsidiary to develop recommendations and input into the overall budget process for the Company. Each individual Board of Directors is ultimately responsible for final decisions on compensation,pertaining to compensation; however, this Committee makes recommendations to the various Boards based upon overall Company policy. The Human Resources Committee met two (2)four (4) times during 2005.2008.

89

The Human Resources Committee meets on an as needed basis to review the salaries and compensation programs required to attract and retain the Company’s executive officers and those of its subsidiaries. The Committee participates in the budget process by recommending salary levels for executive and senior officers to be approved by the respective Boards of Directors of the Company and its subsidiaries. The Committee makes recommendations to each of the Boards of Directors regarding the compensation of executive and senior officers with the respective Boards of Directors ultimately determining such compensation. The salary of each of the Company’s executive and senior officers is determined based upon the officer’s experience, managerial effectiveness, contribution to the Company’s overall profitability, maintenance of regulatory compliance standards and professional leadership. The Committee also compares the compensation of the Company’s executive and senior officers with compensation paid to executives of similarly situated bank holding companies, other businesses in the Company’s market area and appropriate state and national salary data.

Nominating Committee. The current members of the Nominating Committee are John P. MurrayJames E. Nance – Chair, Joe S. Brooks,Ronald T. Burleson, Charles D. Horne, W. Chester Lowder, Emmett S. Patterson, Timothy J. Propst, Susan J. Rourke, Donald P. Scarborough, Douglas L. StaffordStafford; and Hugh E. Wallace.Emily M. Thomas. The Nominating Committee recommended the seven (7)six (6) nominees listed abovefor election to the Board of Directors. The Nominating Committee met two (2)three (3) times during 2005. The Nominating Committee has adopted a written charter, which was included as an Exhibit to the Proxy Statement for the Company’s 2004 Annual Meeting of Shareholders.2008.

Recommendations of nominee candidates by shareholders for the 20072010 Annual Meeting should be submitted in writing to the Chief Executive Officer of the Company by December 1, 2006,2009, and should be accompanied by a statement of each candidate’s qualifications and willingness to serve as a director. In order to stand for election to the Board of Directors, nominees must have economic, business or residential ties to one or more of the Company’s market areas and must be in compliance with the Company’s Policy Statement and Guidelines for Uwharrie Capital Corp Stock Ownership by Directors. A copy of the Policy Statement may be obtained free of charge upon written request made to the Secretary of the Company.

ReportExamining Committee.The current members of the Examining Committee

The Examining Committee are John W. Shealy, Jr. – Chair, Joe S. Brooks, Ronald T. Burleson, Thomas M. Hearne, Charles D. Horne and Joseph R. Kluttz, Jr.Additionally, Emmett S. Patterson, W. Stephen Aldridge, III, and Estus B. White, who are directors of Anson Bank & Trust Co., Bank of Stanly and Cabarrus Bank & Trust Company, respectively, also serve as members of the Company is responsible for receiving and reviewing the annual audit reportCommittee. The members of the Company’s independent auditors and reports of examinations by bank regulatory agencies, and helps formulate, implement, and review the Company’s and its subsidiaries’ internal audit programs. The Examining Committee assesses the performance and independence of the Company’s independent auditors and recommends their appointment and retention. The Examining Committee has in place pre-approval policies and procedures that involve an assessment of the performance and independence of the Company’s independent auditors, an evaluation of any conflicts of interest that may impair the independence of the independent auditors and pre-approval of an engagement letter that outlines all services to be rendered by the independent auditors.

During the course of its examination of the Company’s audit process in 2005, the Examining Committee reviewed and discussed the audited financial statements with management. The Examining Committee also discussed with the independent auditors, Dixon Hughes PLLC, all matters required to be discussed by the Statement of Auditing Standards No. 61, as amended. Furthermore, the Examining Committee received from Dixon Hughes PLLC disclosures regarding their independence required by the Independence Standards Board Standard No. 1, as amended and discussed such information with Dixon Hughes PLLC.

Based on the review and discussions above, the Examining Committee (i) recommended to the Board of Directors that the audited financial statements be included in the Company’s annual report on Form 10-K for the year ended December 31, 2005 for filing with the SEC and (ii) recommended that shareholders ratify the appointment of Dixon Hughes PLLC as auditors for 2006.

The Company is not a member of any securities exchange. However, the Examining Committee members are both “independent” and “financially literate” as defined by the NASDAQ listingunder applicable standards. The Board of Directors has determined that John W. Shealy, Jr., a member of the Examining Committee, meets the requirements of the SEC for qualification as an “audit

9

committee financial expert.” An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of GAAP in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that are of the same level of complexity that can be expected in the reporting company’s financial statements, or experience supervising people engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The Examining Committee has considered whether the principal accountant’s provision of other non-audit services to the Company is compatible with maintaining the independence of Dixon Hughes PLLC. The Examining Committee has determined that it is compatible with maintaining the independence of Dixon Hughes PLLC.

The Examining Committee has a written charter which is reviewed by the Committee for adequacy on an annual basis and which was attached as an Exhibit to the proxy statement for the Company’s 2005 Annual Meeting of Shareholders. 10

The Examining Committee met six (6)seven (7) times during 2005.

This report is submitted by the 2005 Examining Committee: John W. Shealy, Jr. - Chair, Thomas M. Hearne, Joseph R. Kluttz, Jr., Michael E. Snyder, Sr. and Hugh E. Wallace, all of whom are directors of Uwharrie Capital Corp. Also serving as membersin 2008. The Report of the committee areExamining Committee is included on page 20 of this proxy statement.

Director Compensation

During 2008, each director received a fee of $200 for each Board of Directors meeting attended and $100 for attendance at each meeting of a committee. Beginning in July of 2008, directors Anita E. Blair – Bankbegan receiving a travel allowance for meetings attended.

On March 1, 1994, the Company established a Directors’ Deferred Compensation Plan in accordance with the laws of Stanly board representative; Eugene M. Ward – Anson Bank & Trust Co. board representative; and Estus B. White – Cabarrus Bank & Trustthe State of North Carolina under which each director could elect to defer receipt of fees for services rendered to the Company board representative.as a director during the term of his or her service by entering into a written deferred compensation election. This plan was closed to new participants in 2001; subsequently, only one director continued to defer receipt of fees under the plan during 2008. As of December 31, 2008 this plan was terminated.

DIRECTOR COMPENSATION TABLE

Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards | All Other Compensation(5) | Total | ||||||||

Joe S. Brooks | $ | 2,500 | — | — | $ | 80 | $ | 2,580 | |||||

Ronald T. Burleson(1) | 1,200 | — | — | 70 | 1,270 | ||||||||

Henry E. Farmer, Sr. | 800 | — | — | 30 | 830 | ||||||||

Charles F. Geschickter, III | 1,500 | — | — | 40 | 1,540 | ||||||||

Thomas M. Hearne, Jr. | 2,500 | — | — | 100 | 2,600 | ||||||||

Charles D. Horne | 2,000 | — | — | 225 | 2,225 | ||||||||

Joseph R. Kluttz, Jr. | 1,900 | — | — | 80 | 1,980 | ||||||||

B. Franklin Lee(2) | 600 | — | — | — | 600 | ||||||||

W. Chester Lowder | 1,400 | — | — | 30 | 1,430 | ||||||||

Barry S. Moose(3) | — | — | — | — | — | ||||||||

John P. Murray, M.D. (4) | 1,200 | — | — | — | 1,200 | ||||||||

James E. Nance | 2,300 | — | — | 70 | 2,370 | ||||||||

Emmett S. Patterson | 1,700 | — | — | 180 | 1,880 | ||||||||

Timothy J. Propst | 2,100 | — | — | 150 | 2,250 | ||||||||

Susan J. Rourke | 1,600 | — | — | 120 | 1,720 | ||||||||

Donald P. Scarborough | 1,800 | — | — | 180 | 1,980 | ||||||||

John W. Shealy, Jr. | 1,600 | — | — | 210 | 1,810 | ||||||||

Michael E. Snyder, Sr. | 3,400 | — | — | 110 | 3,510 | ||||||||

Douglas L. Stafford | 1,600 | — | — | 180 | 1,780 | ||||||||

Emily M. Thomas | 2,000 | — | — | 270 | 2,270 | ||||||||

| (1) | Mr. Burleson joined the Board of Directors effective May 13, 2008. |

| (2) | Mr. Lee’s term as a member of the Board of Directors expired effective May 13, 2008. |

| (3) | Mr. Moose was appointed to the Board of Directors on December 16, 2008 to fill a vacancy. |

| (4) | Dr. Murray’s term as a member of the Board of Directors ended on July 30, 2008 as a result of his death. |

| (5) | Beginning in July 2008 directors received a travel allowance for attendance at Board of Directors and committee meetings. |

11

Executive Officers

The following table contains information about the executive officers of the Company and its direct and indirect subsidiaries.

Name and Age | Positions with the Company and/or Subsidiary and Prior Experience | Employed

| ||

Roger L. Dick

| President and Chief Executive Officer, Uwharrie Capital Corp | 1983 | ||

Brendan P. Duffey

| Executive Vice President and Chief Operating Officer, Uwharrie Capital Corp; formerly, Vice President and General Manager, Global Knowledge Network, Inc., 1999-2004 | 2004 | ||

| Chief Financial Officer, Uwharrie Capital Corp; formerly, Executive Vice President and Chief Administrative Officer FNB United 2006-2007; Executive Vice President and Chief Financial Officer, First Charter Corp., 1974 – 2005 | 2008 | ||

Barbara S. Williams (65) | Executive Vice President and | |||

Christy D. Stoner

| President and Chief Executive Officer of The Strategic Alliance Corporation and BOS Agency, Inc.; Chief Executive Officer, Strategic Investment Advisors, | 1991 | ||

Jeffrey M. Talley (35) | President, Strategic Investment Advisors, Inc. | 1997 | ||

W. D. “Bill” Lawhon, Jr.

| President and Chief Executive Officer, Bank of Stanly; formerly, Senior Vice President, First Citizens Bank, 1990-2002 | 2002 | ||

10

|

|

| ||||

Jimmy L. Strayhorn

| President and Chief Executive Officer, Anson Bank & Trust Co.; formerly, Vice President and Regional Executive, BB&T, 1975-2002 | 2002 | ||||

Patricia K. Horton

| President and Chief Executive Officer, Cabarrus Bank & Trust Company; formerly, Senior Vice President, First Charter Bank, 1972-2004 | 2004 | ||||

| ||||||

Executive Compensation

The following tableSummary Compensation Table shows for 2005, 2004all cash and 2003 thenon-cash compensation paid to or received or deferred by Roger L. Dick, Brendan P. Duffey, Robert O. Bratton, Barbara S. Williams, Christy D. Stoner, Jeffrey M. Talley, W.D. “Bill” Lawhon, Jr., Jimmy L. Strayhorn and Patricia K. Horton (the “Named Executive Officers”) for services rendered in all capacities during the executive officersfiscal years ended December 31, 2008 and 2007. Compensation paid to the Named Executive Officers consisted of cash salary, bonus, equity compensation in the form of incentive stock option awards, 401(k) matching contributions, insurance premiums paid on behalf of each of the Named Executive Officers, commission-based compensation and certain perquisites. The table below summarizes the dollar amounts of each element of compensation and for incentive stock options, the expense recognized by the Company and its direct and indirect subsidiaries. No other current executive officerpursuant to Statement of Financial Accounting Standards

12

No. 123, as revised. None of the Named Executive Officers received compensation forperquisites in an aggregate amount exceeding $10,000 during the fiscal years indicated which exceeded $100,000.ended December 31, 2008 or 2007.

SUMMARY COMPENSATION TABLE

| Annual Compensation | Awards Options | All Other Compensation(3) | |||||||||||||

Name and Principal Position | Year | Salary(1) | Bonus(2) | ||||||||||||

Roger L. Dick, President and Chief Executive Officer of the Company | 2005 2004 2003 | | $ | 210,756 192,981 171,423 | $ | 5,269 2,150 47,192 | — — — | | $ | 6,519 5,863 6,077 | |||||

Brendan P. Duffey, Executive Vice President and Chief Operating Officer of the Company | 2005 2004 | (4) | | 190,000 117,410 | | 4,750 — | — 69,123 | | | 4,904 476 | |||||

Virginia R. Dunn, Executive Vice President and Chief Financial Officer of the Company | 2005 | (5) | 50,000 | — | 34,919 | (6) | — | ||||||||

Christy D. Stoner, President and Chief Executive Officer of The Strategic Alliance Corporation, Strategic Investment Advisors, Inc. and BOS Agency, Inc.; Executive Vice President of Marketing of the Company | 2005 2004 2003 | | | 129,792 129,792 129,376 | | 3,245 1,622 34,522 | — — — | | | 3,994 3,981 4,878 | |||||

W. D. “Bill” Lawhon, Jr., President and Chief Executive Officer, Bank of Stanly | 2005 2004 2003 | | | 99,840 99,840 96,640 | | 3,309 2,007 5,768 | — — — | | | 3,146 3,116 1,988 | |||||

Jimmy L. Strayhorn, President and Chief Executive Officer, Anson Bank & Trust Co. | 2005 2004 2003 | | | 93,600 93,600 90,600 | | 2,426 1,603 3,430 | — — — | | | 2,916 2,909 1,834 | |||||

Patricia K. Horton, Chief Executive Officer, Cabarrus Bank & Trust Company | 2005 2004 | (7) | | 110,000 60,500 | | 2,861 405 | — — | | | 3,476 — | |||||

Robert B. Brannan, III, President, Cabarrus Bank & Trust Company | 2005 | (8) | 30,859 | — | 12,000 | — | |||||||||

Name and Principal Position | Year | Salary(1) | Bonus | Option Awards(2) | Non-Equity Incentive Plan Compensation(3) | Nonqualified Deferred Compensation Earnings | All Other Compensation(4) | Total | ||||||||||||||

Roger L. Dick, | 2008 | $ | 236,206 | $ | 35,000 | — | $ | 5,838 | $ | 125,000 | $ | 21,459 | $ | 423,503 | ||||||||

| 2007 | 230,170 | 34,000 | — | 11,508 | 38,969 | 14,565 | 329,212 | |||||||||||||||

| 2006 | 222,400 | 13,000 | — | 11,120 | 38,100 | 13,242 | 297,862 | |||||||||||||||

Brendan P. Duffey, | 2008 | 215,509 | 32,000 | — | 5,326 | 98,500 | 16,404 | 367,738 | ||||||||||||||

| 2007 | 210,002 | 29,000 | — | 10,500 | 49,250 | 13,972 | 312,724 | |||||||||||||||

| 2006 | 202,920 | 13,000 | — | 10,146 | — | 11,672 | 237,738 | |||||||||||||||

Robert O. Bratton | 2008 | 27,000 | — | — | — | — | 193 | 27,193 | ||||||||||||||

| 2007 | — | — | — | — | — | — | — | |||||||||||||||

| 2006 | — | — | — | — | — | — | — | |||||||||||||||

Barbara S. Williams, | 2008 | 96,296 | 6,000 | — | 2,480 | — | 6,573 | 111,349 | ||||||||||||||

| 2007 | 93,832 | 5,800 | — | 4,717 | — | 6,204 | 110,553 | |||||||||||||||

| 2006 | 90,549 | 5,000 | — | 4,527 | — | 5,349 | 105,425 | |||||||||||||||

Christy D. Stoner, | 2008 | 144,453 | 10,000 | — | 3,670 | 43,300 | 50,539 | 251,962 | ||||||||||||||

| 2007 | 141,159 | 8,500 | — | 7,058 | 11,458 | 56,744 | 224,919 | |||||||||||||||

| 2006 | 140,780 | 8,500 | — | 7,039 | 5,029 | 8,562 | 169,910 | |||||||||||||||

Jeffrey M. Talley, | 2008 | 81,344 | 8,500 | — | 2,034 | — | 90,964 | 164,813 | ||||||||||||||

| 2007 | 81,344 | 5,800 | — | 4,097 | — | 68,326 | 159,567 | |||||||||||||||

| 2006 | — | — | — | — | — | — | — | |||||||||||||||

W. D. “Bill” Lawhon, Jr., | 2008 | 132,271 | 8,500 | — | 3,299 | — | 17,819 | 161,889 | ||||||||||||||

| 2007 | 128,891 | 8,500 | — | 6,445 | — | 8,517 | 152,353 | |||||||||||||||

| 2006 | 123,202 | — | — | 6,162 | — | 6,999 | 136,363 | |||||||||||||||

Jimmy L. Strayhorn, | 2008 | 109,834 | 7,000 | — | 2,715 | 117,000 | 9,696 | 264,275 | ||||||||||||||

| 2007 | 107,028 | 4,200 | — | 5,351 | 13,348 | 7,317 | 137,244 | |||||||||||||||

| 2006 | 103,427 | 5,000 | — | 5,171 | 8,719 | 6,206 | 128,523 | |||||||||||||||

Patricia K. Horton, | 2008 | 125,757 | 6,500 | — | 3,108 | — | 12,964 | 148,360 | ||||||||||||||

| 2007 | 122,543 | 11,450 | — | 6,433 | — | 8,015 | 148,441 | |||||||||||||||

| 2006 | 118,411 | 8,000 | — | 5,921 | — | 6,929 | 139,261 | |||||||||||||||

| (1) | Includes amounts deferred at the officers’ election pursuant to the Company’s Section 401(k) savings plan. |

11

| (2) | Calculated in accordance with FAS 123R. The assumptions used in estimating the fair value of options are set forth in note 15 to the Company’s audited consolidated financial statements at December 31, 2008. |

Stock Options and Incentives

At the 2006 Annual Meeting, the shareholders of the Company approved the Uwharrie Capital Corp 2006 Incentive Stock Option Plan. The 2006 Incentive Stock Option Plan provides for the issuance of up to 154,971 shares (as adjusted for stock dividends) of the Company’s common stock to officers and other full-time “key employees” of the Company and its subsidiaries upon the exercise of incentive stock options meeting the qualifications of Section 422 of the Internal Revenue Code.

The Shareholders also approved the Uwharrie Capital Corp 2006 Employee Stock Purchase Plan at the 2006 Annual Meeting. The Employee Stock Purchase Plan provides for the grant of purchase options of up to 103,234 shares of the Company’s common stock upon the exercise of purchase options meeting the qualifications of Section 423 of the Internal Revenue Code.

No incentive stock options or purchase options were granted to the Named Executive Officers during 2007 and 2008.

14

The following table sets forth information regarding estimated future payouts under the Company’s quarterly incentive plan.

GRANTS OF PLAN BASED AWARDS

Estimated Future Payouts Under Non-Equity Incentive Plan Awards | |||||||||||||||

Name | Grant Date | Threshold | Target | Maximum | All other Stock Awards; Number of Shares of Stock or Units | All other Option Awards; Number of Securities Underlying Options | Exercise or Base Price of Option Awards | ||||||||

Roger L. Dick | — | — | $ | 5,838 | — | — | — | — | |||||||

Brendan P. Duffey | — | — | 5,326 | — | — | — | — | ||||||||

Robert O. Bratton | — | — | — | — | — | — | — | ||||||||

Barbara S. Williams | — | — | 2,480 | — | — | — | — | ||||||||

Christy D. Stoner | — | — | 3,670 | — | — | — | — | ||||||||

Jeffrey M. Talley | — | — | 2,034 | — | — | — | — | ||||||||

W.D. “Bill” Lawhon, Jr. | — | — | 3,299 | — | — | — | — | ||||||||

Jimmy L. Strayhorn | — | — | 2,715 | — | — | — | — | ||||||||

Patricia K. Horton | — | — | 3,108 | — | — | — | — | ||||||||

The following table sets forth information regarding vested and unvested incentive stock options to purchase sharesoutstanding as of December 31, 2008. All of the Company’s commonoutstanding stock that wereoptions have been granted at 100% of fair market value on the date of grant. The number of shares underlying all outstanding stock options, and the exercise prices associated with each option grant, have been adjusted for the effect of annual 3% stock dividends.

The Company has not adopted any plan providing for the grant of restricted stock or long-term compensation units to employees and, accordingly, all columns in the Company’s executive officerstable below pertaining to restricted stock or long-term compensation have been omitted.

15

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

Name | No. of Securities Underlying Unexercised Options Exercisable | No. of Securities Underlying Options Unexerciseable | Equity Incentive Plan Awards; No. of Securities Underlying Unexercised Unearned Options | Option Exercise Price | Option Expiration Date | ||||||

Roger L. Dick | 70,590 | — | — | $ | 4.22 | Nov. 29, 2009 | |||||

Brendan P. Duffey | 64,099 | 16,034 | — | 5.35 | May 19, 2014 | ||||||

Robert O. Bratton | — | — | — | — | — | ||||||

Barbara S. Williams | 17,354 | — | — | 4.22 | Nov. 29, 2009 | ||||||

Christy D. Stoner | 90,551 | — | — | 4.22 | Nov. 29, 2009 | ||||||

Jeffrey M. Talley | — | — | — | — | — | ||||||

W.D. “Bill” Lawhon, Jr. | 29,851 | — | — | 4.61 | Nov. 19, 2012 | ||||||

Jimmy L. Strayhorn | 67,527 | — | — | 4.61 | Nov. 19, 2012 | ||||||

Patricia K. Horton | — | — | — | — | — | ||||||

Three of the Named Executive Officers exercised stock options during the fiscal year ended December 31, 2005.2008.

OPTION GRANTS IN FISCAL YEAR 2005

(INDIVIDUAL GRANTS)

Name | Number of Options Granted | % of Total to Employees | Exercise or Base Price | Expiration Date | Grant Date Value(1) | ||||||||

Roger L. Dick | -0- | — | — | — | — | ||||||||

Brendan P. Duffey | -0- | — | — | — | — | ||||||||

Virginia R. Dunn(2) | 34,919 | (3) | 41.25 | % | $ | 6.15 | Sept. 1, 2015 | -0- | |||||

Christy D. Stoner | -0- | — | — | — | — | ||||||||

W.D. “Bill” Lawhon, Jr. | -0- | — | — | — | — | ||||||||

Jimmy L. Strayhorn | -0- | — | — | — | — | ||||||||

Patricia K. Horton | -0- | — | — | — | — | ||||||||

Robert B. Brannan, III | 12,000 | 14.18 | % | $ | 6.20 | Oct. 6, 2015 | -0- | ||||||

12

The following table contains information with respect to stock options exercised during 2005 and held at December 31, 2005 by executive officers of the Company and its direct and indirect subsidiaries.

AGGREGATED OPTION EXERCISES IN 2005

AND YEAR-END OPTION VALUES

Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at 12/31/05 | Value of Unexercised at 12/31/05(1) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Roger L. Dick | 3,173 | $ | 5,001 | 85,259 | -0- | $ | 132,301 | -0- | |||||||

Brendan P. Duffey | -0- | -0- | 14,666 | 58,667 | $ | 4,488 | $ | 17,952 | |||||||

Virginia R. Dunn(2) | -0- | -0- | -0- | 35,967 | -0- | $ | 6,438 | ||||||||

Christy D. Stoner | -0- | -0- | 90,247 | -0- | $ | 139,578 | -0- | ||||||||

W.D. “Bill” Lawhon, Jr. | -0- | -0- | 16,336 | 10,982 | $ | 18,247 | $ | 12,267 | |||||||

Jimmy L. Strayhorn | -0- | -0- | 36,954 | 24,842 | $ | 41,278 | $ | 27,749 | |||||||

Patricia K. Horton | -0- | -0- | -0- | -0- | -0- | -0- | |||||||||

Robert B. Brannan, III | -0- | -0- | -0- | 12,360 | -0- | $ | 1,619 | ||||||||

Employee Stock Ownership Plan

On January 1, 1999, the Uwharrie Capital Corp Employee Stock Ownership Plan and Trust (“ESOP”) became effective. Under the ESOP, all full-time employeesassociates who have beenwere employed by the Company or any of its direct or indirect subsidiaries for six monthsat least 1,000 hours during a given plan year and who have attained the age of 18 and all part-time employeesare eligible to participate. All ESOP participants who have beenwere employed by the Company or any of its direct or indirect subsidiaries for 12 months and attained the age of 18,prior to January 1, 2007 are eligiblefully vested in their ESOP accounts. Participants who were hired on or after January 1, 2007 are subject to participate.a three-year cliff vesting schedule with respect to their ESOP accounts. Pursuant to the ESOP, 299,861390,539 dividend-adjusted shares are held in trust, with Robert O. Bratton, Roger L. Dick, Brendan P. Duffey, David C. Gaskin, Susan B. Gibson, J. Michael Massey, Christy D. Stoner, and Barbara S. Williams as trustees.

Compensation Committee Interlocks and Insider ParticipationSupplemental Retirement Plan

No memberThe Company has implemented a non-qualifying deferred compensation plan for certain executive officers. Certain of the Human Resources Committee is now, or formerly was, an officer or employeeplan benefits will accrue and vest during the period of employment, and will be paid in fixed monthly benefit payments for up to ten years commencing with the officer’s retirement at any time after attainment of the age specified in the officer’s plan agreement. The plan also provides for payment of death benefits and for payment of disability benefits in the event the officer becomes permanently disabled prior to attainment of retirement age.

16

Effective December 31, 2008, this plan was amended and restated to comply with Section 409A of the Internal Revenue Code. The participants’ account liability balances as of December 31, 2008 will be transferred into a trust fund, where investments will be participant-directed. The plan is structured as a defined contribution plan and the Company’s expected annual funding contribution for the participant has been calculated through the participant’s expected retirement date. Under terms of the agreement, the Company has reserved the absolute right, at its sole discretion, to either fund or anyrefrain from funding the plan. The plan also provides for payment of death benefits and for payment of disability benefits in the event the officer becomes permanently disabled prior to attainment of retirement age.

PENSION BENEFITS

Name | Plan Name | No. of Years of Credited Service | Accumulated Benefit | Payments During Last Fiscal Year | |||||

Roger L. Dick | Sup. Exec. Retirement | 25 | $ | 531,832 | -0- | ||||

Brendan P. Duffey | Sup. Exec. Retirement | 4 | 147,750 | -0- | |||||

Robert O. Bratton | — | — | -0- | -0- | |||||

Barbara S. Williams | — | — | -0- | -0- | |||||

Christy D. Stoner | Sup. Exec. Retirement | 17 | 139,937 | -0- | |||||

Jeffrey M. Talley | — | — | -0- | -0- | |||||

W.D. “Bill” Lawhon, Jr. | — | — | -0- | -0- | |||||

Jimmy L. Strayhorn | Sup. Exec. Retirement | 6 | 295,291 | -0- | |||||

Patricia K. Horton | — | — | -0- | -0- | |||||

The Company has purchased life insurance policies on certain of its direct or indirect subsidiaries.

13

Reportexecutive officers. The Company has entered into Endorsement Method Split-Dollar Plan Agreements (the “Split-Dollar Agreements”) with Roger L. Dick, Christy D. Stoner and Jimmy L. Strayhorn. Under the terms of the Human Resources Committee

The Human Resources Committee meets on an as needed basis to reviewSplit-Dollar Agreements, the salaries and compensation programs required to attract and retain the Company’s executive officers and those of its subsidiaries. The Committee participates in the budget process by recommending salary levels for executive and senior officers to be approved by the respective Boards of Directors ofproceeds from each policy are divided between the Company and its subsidiaries. While the committee makes recommendations to eachexecutive, with the executive’s designated beneficiary receiving 85% of the Boards of Directors regardingdifference between the compensation of its executive and senior officers, the respective Board of Directors ultimately determines such compensation. The salary of eachtotal proceeds of the Company’s executivepolicy and senior officers is determined based upon the officer’s experience, managerial effectiveness, contribution to the Company’s overall profitability, maintenancepolicy’s cash value. As of regulatory compliance standards and professional leadership. The Committee also compares the compensation of the Company’s executive and senior officers with compensation paid to executives of similarly situated bank holding companies, other businesses in the Company’s market area and appropriate state and national salary data. These factors were considered in establishing the compensation of the Company’s President and Chief Executive Officer during the fiscal year ended December 31, 2005. All executive2008, the survivor’s benefit for the named beneficiaries of Mr. Dick, Mr. Duffey, Ms. Stoner and senior officers of the Company, including the Chief Executive Officer, are eligible to receive discretionary bonuses declared by the Board of Directors. The amount of such bonusesMr. Strayhorn under these life insurance policies was $2,283,225, $1,000,000, $1,060,319 and incentive payments is based upon the Company’s budget and the attainment of corporate goals and objectives. Finally, the interests of the Company’s executive and senior officers are aligned with those of the shareholders through the use of equity-based compensation, specifically the grant of stock options with exercise prices established at the fair market value of the Company’s common stock at the time of grant.$365,523, respectively.

This report is submitted by the Human Resources Committee: Timothy J. Propst - Chair, Robert P. Barbee, B. Franklin Lee, W. Chester Lowder, Susan J. Rourke and Emily M. Thomas.

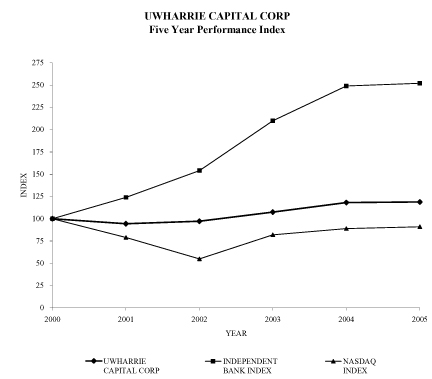

Performance Graph

The following graph compares (i) the yearly change in the cumulative total stockholder return on the Company’s common stock with (ii) the cumulative return of the Carson Medlin Company Independent Bank Index, and (iii) the Nasdaq Composite. The graph assumes that the value of an investment in the Company’s common stock and in each index was $100 on December 31, 2000, and that all dividends were reinvested. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

14

Transactions with Management

The Bank of Stanly, Anson Bank & Trust Co., Cabarrus Bank & Trust Company and The Strategic Alliance Corporation have had, and expect to have in the future, transactions in the ordinary course of business with certain of the directors and executive officers and their associates of the Company and its direct and indirect subsidiaries. All loans included in such transactions were made on substantially the same terms, including interest rates, repayment terms and collateral, as those prevailing at the time for comparable transactions with other persons, and do not involve more than the normal risk of collectibility or present other unfavorable features.

17

Loans made by the Company’s bank subsidiaries to directors and executive officers are subject to the requirements of Regulation O of the Board of Governors of the Federal Reserve System. Regulation O requires, among other things, prior approval of the Board of Directors with any “interested director” not participating, dollar limitations on amounts of certain loans and prohibits any favorable treatment being extended to any director or executive officer in any of the Bank’s lending matters. To the best knowledge of the management of the Company and its bank subsidiaries, Regulation O has been complied with in its entirety.

15

PROPOSAL 2: APPROVAL OF 2006 INCENTIVE STOCK OPTION PLANADVISORY VOTE ON EXECUTIVE COMPENSATION

The Uwharrie Capital Corp 1996 Employee Stock Option Plan (originally the Stanly Capital Corp 1996 Employee Stock Option PlanAmerican Recovery and hereinafter, the “1996 Incentive Plan”Reinvestment Act of 2009 (“ARRA”) was approved byenacted on February 17, 2009. This law requires that any proxy statement for an annual meeting of the Board of Directors and shareholders of any participant in the Company in 1996. The 1996 Incentive Plan originally provided for the grant of incentive stock options covering up to 212,400 sharesU.S. Department of the Company’s common stock, of which 153,132 shares (as adjustedTreasury’s TARP Capital Purchase Program include a separate proposal in its proxy statement for subsequent stock dividends) currently remain available for future issuance. Section 422(b)(2)a non-binding shareholder vote on the compensation paid to its executive officers, as disclosed pursuant to the compensation disclosure rules of the Internal Revenue Code (the “Code”) states that no incentive stock options may be granted more than ten (10) years afterSEC. This “say on pay” proposal is required during the date onperiod in which an incentive stock option plan is originally adopted. Accordingly, the 1996 Incentive Plan expired on February 20, 2006 and following that date, no further stock options can be grantedany obligation arising as a result of participation under the plan. In order to ensure the Company’s continuing ability to attract and retain key employees through the grant of incentive stock options, the Executive Committee of theTARP Capital Purchase Program remains outstanding.

Accordingly, our Board of Directors has recommendedproposed the following resolution for shareholder consideration:

Resolved, that the shareholders approve thecompensation paid or provided to executive officers of Uwharrie Capital Corp 2006 Incentive Stock Option Plan (the “2006 Incentive Plan”“Company”). The 2006 Incentive Plan provides for the issuance of stock options to purchase up to a total of 153,132 shares of the Company’s common stock (“Incentive Options”) to officers and other full-time “key employees” of the Company and its subsidiaries, (“Optionees,” including executive officers ofand the CompanyCompany’s and its subsidiaries, but excluding any director who is not also a full-time employee ofsubsidiaries’ executive compensation policies and practices, as described in the Company or one of its subsidiaries). The terms of the 2006 Incentive Plan are substantially identical to those of the 1996 Incentive Plantabular and the 2006 Incentive Plan permits the grant of options covering an aggregate number of shares (subject to adjustment for changesnarrative compensation disclosures contained in the Company’s capitalization, such as stock splitsproxy statement for its 2009 Annual Meeting, hereby are ratified and stock dividends) equal toapproved.

As provided in ARRA, the number of shares that remained available for issuance in connection with stock options remaining available for grant under the 1996 Incentive Plan upon its termination.

The purpose of the 2006 Incentive Plan generally is to assist the Company and its subsidiaries in attracting and retaining key employees whose interests are the same as those ofvote by our shareholders and to provide an additional incentive for employees to whom Options are granted to perform at levels that will enhance the Company’s financial performance and shareholder value.

The 2006 Incentive Plan will be administered by a committee (the “Committee”) appointed by and consisting of three or more members of the Company’snon-binding, advisory vote. The vote will not be binding on our Board of Directors who areor our Human Resources Committee and will not employees ofoverrule or affect any previous action or decision by the CompanyBoard or Committee or any of its subsidiariescompensation previously paid or awarded, and who are otherwise “disinterested directors” as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), and (subject to adjustment as described below) generally provides for the issuance and sale of up to an aggregate of 153,132 shares of the Company’s common stock (“Common Stock”) upon the exercise of Stock Options. At the discretion of the Committee, Options granted under the 2006 Incentive Plan may be incentive stock options (“ISOs”) pursuant to Section 422A of the Code or they may be nonqualified stock options (“NSOs”). Among other things, the Committee is authorized to make all determinations regarding the persons to whom and numbers of shares for which Options will be granted, to interpret and establish rules and to make all determinations and take all other actions relating to and reasonable or advisable in administering the 2006 Incentive Plan. To the extent permitted by applicable law, members of the Committee will be indemnified by the Company for legal expenses and liability incurred in connection with the administration of the Stock Option Plan.

16

The price per share (the “Exercise Price”) of Common Stock covered by each Option granted shall be set by the Committee at the time the Option is granted, but may not be less than 100% of the fair market value (as determined by the Committee in such manner as it in its sole discretion, deems to be reasonable and appropriate) of a share of Common Stock at the time the Option is granted (or 110% in the case of an ISO granted to an Optionee who owns more than 10% of the voting power of the outstanding Common Stock). Based on information available to management of the Company, at December 31, 2005,the fair market value of a share of Common Stock was approximately $6.15.

Each Option will become exercisable as specified by the Committee at the time of grant (but not before the Optionee has completed one full year of service following the date of grant), and, to the extent not previously exercised, will expire and may not thereafter be exercised after the earlier of: (i) the expiration date set by the Committee at the time of grant, which may be no more than 10 years after the date of grant (or 5 years in the case of an ISO granted to an Optionee who owns more than 10% of the voting power of the Common Stock), (ii) the date the Optionee resigns or on which his or her employment is terminated for “cause” (as defined in the 2006 Incentive Plan); (iii) 90 days following the termination of the Optionee’s employment as a result of his or her disability or retirement, or (iv) 90 days following the termination of the Optionee’s employment other than for cause. With respect to ISOs, the aggregate fair market value (determined as of the date of grant) of Common Stock for which all such Options granted to any Optionee may become exercisable for the first time in any calendar year may not exceed $100,000; and, in connection with any Option granted, the Committee may impose such other restrictions or conditions as it may deem appropriate.

No payment will be received by the Company upon the grant of an Option, but, at the time an Option is exercised, the Optionee must make full payment of the aggregate Exercise Price for shares being purchased. Payment may be made in cash or, with the consent of the Committee, by delivery to the Company of previously owned shares of Common Stock having a fair market value equal to the Exercise Price being paid (or by a combination of Common Stock and cash). Optionees will have no rights as shareholders of the Company with respect to any shares covered by Options granted to them until those Options have been exercised and the Exercise Price of such shares has been paid to the Company.

In the event of increases, decreases or changes in the Company’s outstanding Common Stock resulting from a stock dividend, recapitalization, reclassification, stock split, consolidation, combination or similar event, or resulting from an exchange of shares or merger or other reorganization in which the Company is the surviving entity, then the Committee may make such adjustment as it, in its sole discretion, deems to be appropriate in the aggregate number and kind of shares which may be issued and for which Options may be granted under the 2006 Incentive Plan and which are covered by each then outstanding Option, and in the Exercise Price of each unexercised Option. In the event of the dissolution or liquidation of the Company, the sale of substantially all its assets, or a merger or consolidation or similar reorganization or transaction in which the Company is not the surviving entity, and if provision is not made in such transaction for the continuance of the 2006 Incentive Plan or for assumption of outstanding Options or the substitution of new options covering shares of the successor entity, then each outstanding Option shall become fully vested and immediately exercisable prior to the effective date of such transaction and, to the extent not exercised, shall terminate on such effective date.

17

The Board of Directors, upon recommendation of the Committee, may, from time to time, amend, modify, suspend, terminate or discontinue the 2006 Incentive Plan without notice. However, no such action will adversely affect any Optionee’s rights under any then outstanding Option without such person’s prior written consent, and, except as shall be required to comport with changes in the Code, any modification or amendment of the 2006 Incentive Plan that (i) increases the aggregate number of shares of Common Stock which may be issued upon the exercise of Options, (ii) changes the formula by which the Exercise Price is determined, (iii) changes the provisions of the 2006 Incentive Plan with respect to the determination of persons to whom Options may be granted, or (iv) otherwise materially increases the benefits accruing to Optionees under the 2006 Incentive Plan, shall be subject to the approval of the Company’s shareholders. Consistent with the terms of the 2006 Incentive Plan, the Committee may modify, extend or renew any outstanding Option pursuant to a written agreement with the Optionee.

ISOs granted under the 2006 Incentive Plan are intended to qualify for certain favorable income tax treatment. Under the Code, an Optionee is not taxed in the year in which an ISO is exercised. If an Optionee holds stock purchased upon the exercise of an ISO for a period of at least two years following the date of grant and at least one year from the date the ISO is exercised (or dies while owning the stock) then, upon disposition of the stock (or upon death while owning the stock), he or she will realize capital gain equal to the excess of the sale price of the stock over the Exercise Price. If the Optionee disposes of the stock before the holding periods have expired, the excess of the fair market value of the stock at the time the Option was exercised over the Exercise Price will be treated as ordinary income. The Company will not be permitted to take a tax deduction atcreate or imply any time in connection with ISOs unless stock purchased upon exercise is disposed of prior to expiration ofadditional duty on the two holding periods. In the year in which an NSO is exercised, the Optionee will realize ordinary income equal to the excess of the fair market value of the stock at the time of exercise over the Exercise Price, and the Company is allowed, to take a deduction for the same amount. At its discretion the Committee may withhold from an Optionee’s salary or any other amount due to such Optionee (or from shares being purchased upon the exercise of an Option) the amount of any required tax withholdings for which the Company is responsible.

Under North Carolina law, the creation and adoption of the 2006 Incentive Plan is a matter within the business judgmentpart of the Board of Directors, and such action is not required to be submitted to shareholders for approval.or Committee. However, the 2006 Incentive Plan is being submitted for shareholder approval in order to comply withBoard and the requirements ofHuman Resources Committee will take the Code forvoting results on the issuance of ISOs and, additionally, in order to comply with the requirements of an exemption from certain provisions of Section 16(b) of the Exchange Act provided by Rule 16b-3 promulgated thereunder for certain stock transactions effected by Optionees who are subject to Section 16(b) (primarily the Company’s senior officers). To satisfy the requirements of the Code and to obtain the benefit of the Rule 16b-3 exemption, a majority of the shares of the Company’s outstanding Common Stock represented in person or by proxy and entitled to vote at the Annual Meeting must be voted in favor of the 2006 Incentive Plan.

No options will be granted to employees under the 2006 Incentive Plan until approval of such plan by the Company’s shareholders.

18

A copy of the 2006 Incentive Plan is on file and may be inspected by any shareholder at the Company’s office in Albemarle, North Carolina, and a copy will be available for inspection by any shareholder at the Annual Meeting. Additionally, any shareholder wishing to receive a copy of the 2006 Incentive Plan free of charge should contact Tamara M. Singletary, Executive Vice President – Investor Relations and Corporate Secretary, Uwharrie Capital Corp, 132 North First Street Albemarle, North Carolina 28001.proposed resolution into account when considering future executive compensation matters.

THE BOARD OF DIRECTORS BELIEVES THAT THE COMPANY’S EXECUTIVE COMPENSATION POLICIES AND PRACTICES ARE ALIGNED WITH OUR SHAREHOLDERS’ INTEREST AND RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 2 APPROVINGRATIFICATION OF THE UWHARRIE CAPITAL CORP 2006 INCENTIVE STOCK OPTION PLAN.

PROPOSAL 3: ADOPTION OF 2006 EMPLOYEE STOCK PURCHASE PLAN

The Uwharrie Capital Corp 1996 Employee Stock Purchase Plan (originally the Stanly Capital Corp 1996 Employee Stock Purchase Plan and hereinafter, the “1996 Stock Purchase Plan”) was approved by the Board of Directors and shareholders of the Company in 1996. The Stock Purchase Plan originally provided for the grant of stock purchase options covering up to 63,720 shares of the Company’s common stock. The 1996 Stock Purchase Plan expired on February 20, 2006 and following that date, no further purchase options could be granted under the plan. At the time of its expiration, 94,474 shares (as adjusted for subsequent stock dividends) remained available for future issuance under the 1996 Stock Purchase Plan. In order to ensure the Company’s continuing ability to attract and retain key employees, the Executive Committee of the Board of Directors has recommended that the shareholders approve a new employee stock purchase plan (the “Stock Purchase Plan”) which is intended to be a stock purchase plan under Section 423 of the Code and which provides for the periodic grant of options to purchase shares of the Company’s Common Stock (the “Purchase Options”) to eligible employees of the Company and its subsidiaries. The purpose of the Stock Purchase Plan generally is to encourage the continued service of employees of the Company and its subsidiaries by giving them an opportunity to become shareholders, or to increase their shareholdings, and to share in the benefit of potential increases in the value of the Common Stock.

The Stock Purchase Plan will be administered by a committee (the “Committee”) appointed by and consisting of three or more members of the Company’s Board of Directors who are not employees of the Company or any of its subsidiaries and who are otherwise “disinterested directors” as such term is defined in Rule 16b-3 promulgated under the Exchange Act, and (subject to adjustment as described below) generally provides for the issuance and sale of up to an aggregate of 94,474 shares of the Common Stock upon the exercise of Purchase Options. This number is equal to the number of shares that remained available for issuance in connection with stock options remaining available for grant under the 1996 Stock Purchase Plan upon its expiration.

Among other things, the Committee is authorized to approve the grant of Purchase Options from time to time pursuant to the Stock Purchase Plan, to interpret and establish rules and to make all determinations and take all other actions relating to and reasonable or advisable in administering the Stock Purchase Plan. To the extent permitted by applicable law, members of the Committee will be indemnified by the Company for legal expenses and liability incurred in connection with the administration of the Stock Purchase Plan.

19

Persons eligible to participate in the Stock Purchase Plan as to each separate grant of Purchase Options (“Eligible Employees”) are all those active employees of the Company and its subsidiaries who have completed at least one year of full-time employment as of the date such Purchase Options are granted (the “Date of Grant”). However, persons who are considered “highly compensated” employees (as defined by the Code), directors who are not full-time employees, and employees whose customary employment is less than 20 hours per week or less than five months in any calendar year or who own (or who, after receipt of a Purchase Option, would be deemed to own) shares of the Common Stock that would entitle them to 5% or more of the aggregate combined voting power of all the Common Stock, may not participate in the Stock Purchase Plan.

The Stock Purchase Plan provides for the periodic grant of Purchase Options by the Company. However, the Committee must specifically approve each separate grant of Purchase Options and, in connection with each separate grant, Purchase Options will be granted to all persons who are Eligible Employees as of the Date of Grant. At the time each grant of Purchase Options is approved, the Committee also will specify a dollar amount of annual compensation (the “Annual Factor’), and the number of shares covered by each Eligible Employee’s Purchase Option included in that grant will be equal to that employee’s annual rate of compensation (as of the day prior to the Date of Grant) divided by the Annual Factor for that grant (but in no event more than 500 shares). The Annual Factor may be different for each separate grant of Purchase Options under the Stock Purchase Plan, but in connection with each grant of Purchase Options the Annual Factor will be the same for all Eligible Employees.

The purchase price per share (the “Exercise Price”) of Common Stock covered by Purchase Options included in each separate grant will be a percentage of the “fair market value” of a share of Common Stock on the Date of Grant (the “Applicable Percentage”). The Applicable Percentage for each grant will be set by the Committee at the time of its approval of that grant, but in no event may it be more than 100% or less than 85%. For purposes of the Stock Purchase Plan, the “fair market value” of a share will be determined by the Committee in such manner as it,in its sole discretion, deems to be reasonable and appropriate. No payment will be received by the Company upon the grant of a Purchase Option but, at the time a Purchase Option is exercised, the Eligible Employee must make full payment in cash of the aggregate Exercise Price for shares being purchased. Employees who receive Purchase Options will have no rights as shareholders as to any shares covered by their Purchase Options until they are exercised and they have purchased those shares of Common Stock.

The term of each Purchase Option granted will be approximately 24 months following its Date of Grant. During the term of each Purchase Option, the Optionee may elect during the first 15 calendar days of each December and June to exercise part or all of his or her Purchase Option and purchase part or all the Common Stock to which such Purchase Option relates; provided, however, that no employee may purchase during any calendar year shares having a fair market value (as of the date the Purchase Options were granted) in excess of $25,000.To facilitate purchases of Common Stock, each Eligible Employee may participate in a payroll deduction plan pursuant to which an amount specified by the employee will be deducted from each periodic

20

payment of salary or wages. Deducted amounts will be held in an interest-bearing account at the Bank for the employee and will be applied toward the purchase price of Common Stock purchased upon any exercise by the employee of a Purchase Option. Common Stock sold to an exercising employee may be newly issued shares or shares purchased on the open market.

To the extent not previously exercised, each Option will expire and may not thereafter be exercised after the earlier of: (i) the end of its term, (ii) the date the Eligible Employee resigns or on which his or her employment is terminated for “cause” (as defined in the Stock Purchase Plan); (iii) 90 days following the termination of the Eligible Employee’s employment as a result of his or her disability or retirement, or (iv) 90 days following the termination of the Eligible Employee’s employment other than for cause.

In the event of increases, decreases or changes in the Company’s outstanding Common Stock resulting from a stock dividend, recapitalization, reclassification, stock split, consolidation, combination or similar event, or resulting from an exchange of shares or merger or other reorganization in which the Company is the surviving entity, then the Committee may make such adjustment as it, in its sole discretion, deems to be appropriate in the aggregate number and kind of shares which may be issued and for which Purchase Options may be granted under the Stock Purchase Plan and which are covered by each then outstanding Purchase Option, and in the Exercise Price of each unexercised Purchase Option. In the event of the dissolution or liquidation of the Company, the sale of substantially all its assets, or a merger or consolidation or similar reorganization or transaction in which the Company is not the surviving entity, and if provision is not made in such transaction for the continuance of the Stock Purchase Plan or for assumption of outstanding Purchase Options or the substitution of new options covering shares of the successor entity, then each outstanding Purchase Option shall become fully vested and immediately exercisable prior to the effective date of such transaction and, to the extent not exercised, shall terminate on such effective date.